Case study: Retraites populaires has relied on EPIQR+ since 2001

As an insurance company based in the canton of Vaud, Retraites Populaires is committed to making pension provision accessible to all, while responsibly managing its long-term commitments and investing in a sustainable and socially responsible manner.

Established in 1907, on strong human values, Retraites Populaires operates in a variety of fields:

- Individual savings and pensions (3rd pillar)

- Loans

- Property management and rental

- Occupational pensions

Issues

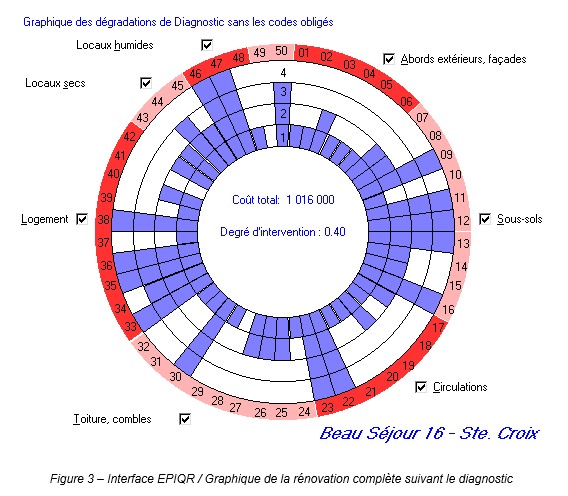

As part of the European InvestImmo project, in which Retraites Populaires took part, the pension fund's property department commissioned EPIQR Rénovation and ESTIA to carry out valuations of 30 buildings in its portfolio that were due to be renovated in the near future.

Solution

These pilot assessments were intended to support the development of a methodology for planning the maintenance work to be carried out on a model building stock. The same work was carried out on buildings in each of the European partner countries.

At the same time as these valuations were being carried out, the Retraites Populaires property department launched studies to develop renovation projects for the 30 buildings in the InvestImmo project.

Results

Thanks to the accuracy and precision of the EPIQR+ database, as well as the experience of the experts who carried out the diagnostics, the definition and costs of the work planned with EPIQR+ were validated by the architects commissioned by Retraites Populaires.

Since then, Retraites Populaire has carried out an appraisal of all its buildings and uses the InvestImmo method to plan the maintenance management of its property portfolio with thorough five-year plans.

Today, Retraites Populaires carries out an EPIQR assessment of all its new acquisitions, either internally or through its agents.

A recent study of the actual costs of 5 Minergie-type renovations after the work was completed showed a correspondence of ±10% between the EPIQR+ costs and the actual costs.